when will i get my mn unemployment tax refund

When Will I Receive My Unemployment Tax Refund. When Should I Expect My Tax Refund In 2022.

Where S My Refund Minnesota H R Block

IRS Form 1099-G will be mailed to everyone who was paid Minnesota unemployment benefits in 2021.

. For this round the average refund is 1686 direct deposit refunds started going out Wednesday and paper checks today. 651-296-3781 or 1-800-652-9094 Email. As far as Minnesota is concerned per the Minnesota Department of Revenue website they have started processing refunds this month.

If you received unemployment in 2020 youll likely get money back from the Minnesota. The IRS anticipates most taxpayers will receive refunds as in past years. The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received in 2020 from federal income tax for households reporting an adjusted gross income less than 150000 on their 2020 tax return.

Most should receive them within 21 days of when they file electronically if they choose direct deposit. If you filed a paper return for a current year Homestead Credit Refund for Homeowners or Renters Property Tax Refund your return information will not be available until July. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their 2020 tax returns.

Hello Since you were able to get through to the IRS and they stated that your refund is processing there isnt much more you can do at this point. Ad Learn How To Track Your Federal Tax Refund And Find The Status Of Your Direct Deposit. Refunds set to start in May Those who filed 2020 tax returns before Congress passed an exclusion on the first 10200 in unemployment benefits could be getting a.

12 rows All 2022 Unemployment Insurance Tax Rate Determinations were sent out by US. The agency is working its way down to the more complex category and expects to complete releasing jobless tax refunds before Dec. Tax refunds on unemployment benefits to start in May.

View step-by-step instructions for accessing your 1099-G by phone. Individuals earning less than 150000 a year were exempted from paying taxes on up to 10200 in unemployment insurance payments under that statute. Individual Income Tax Phone.

Unemployment numbers surged at the. Earlier in the session two. If you received unemployment benefits in Minnesota before 2021 you can also view your previous 1099-G forms.

Unemployment 10200 tax break. The tax break is for those who earned less than 150000 in adjusted gross income and for unemployment insurance received during 2020. FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department officials said.

Last years average federal refund was more than 2800. Individualincometaxstatemnus Business Income Tax Phone. Call the automated phone system.

At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns. Therefore if you received unemployment income in 2020 and paid tax on that. Minnesota Department of Revenue Mail Station 0020 600 N.

Solved The IRS started with making payments to those who had filed simple returns such as single filers. Paul MN 55145-0010 Mail your property tax refund return to. Its taking us more than 21 days and up to 120 days to issue refunds for tax returns with the Recovery Rebate Credit Earned Income Tax Credit and Additional Child Tax Credit.

As a result jobless benefits up to 10200 for individuals earning less than 150000 per year are exempt from tax. If youre due a refund from your tax return you should wait to get it before filing Form 1040-X to amend your original tax return. September 30 2021 249 PM.

Dont file a second tax return. No major tax bill was enacted during the regular 2022 legislative session which ended May 23. Current Tax Law Changes.

Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. This story is part of Taxes 2022 CNETs coverage of the best tax software and everything else you need to get your return filed quickly accurately and on-time.

Irs To Send Another 4 Million Tax Refunds To People Who Overpaid On Unemployment Cbs News

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Because Of One Word Minnesota Can T Issue Refunds For Overpaid Unemployment Tax Minnesota Reformer

2022 Average Irs And State Tax Refund And Processing Times Aving To Invest

How Is Unemployment Taxed Forbes Advisor Forbes Advisor

I R S Will Automatically Refund Taxpayers Eligible For Unemployment Credit The New York Times

Irs Will Automatically Refund Taxes Paid On Some 2020 Unemployment Benefits Ds B

Unemployment Compensation Are Unemployment Benefits Taxable Marca

State Income Tax Returns And Unemployment Compensation

Because Of One Word Minnesota Can T Issue Refunds For Overpaid Unemployment Tax Minnesota Reformer

When Will Irs Send Unemployment Tax Refunds Wbir Com

667k Minnesotans To Get Pandemic Hero Pay Business Unemployment Tax Increase Reversed Twin Cities

Mn Revises 2022 Unemployment Insurance Tax Rates Paylocity

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest

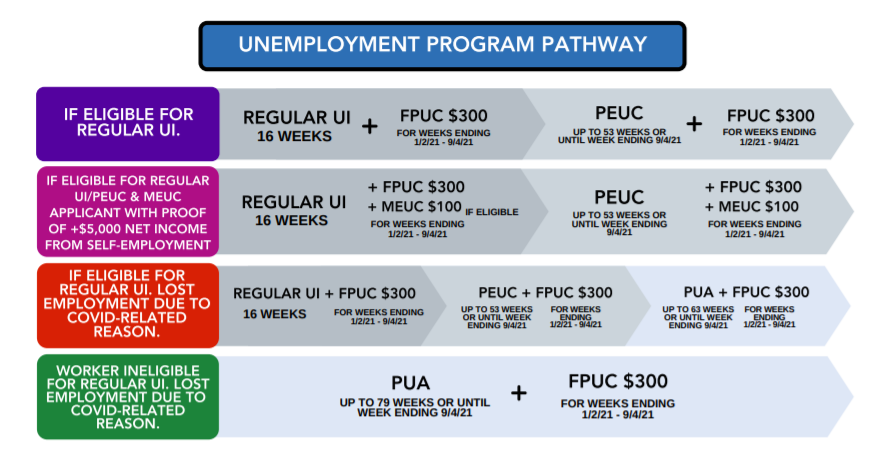

Minnesota Mi Deed Unemployment Benefit Extensions To 300 Fpuc Pua And Peuc Programs Has Ended Retroactive Payment Updates Aving To Invest